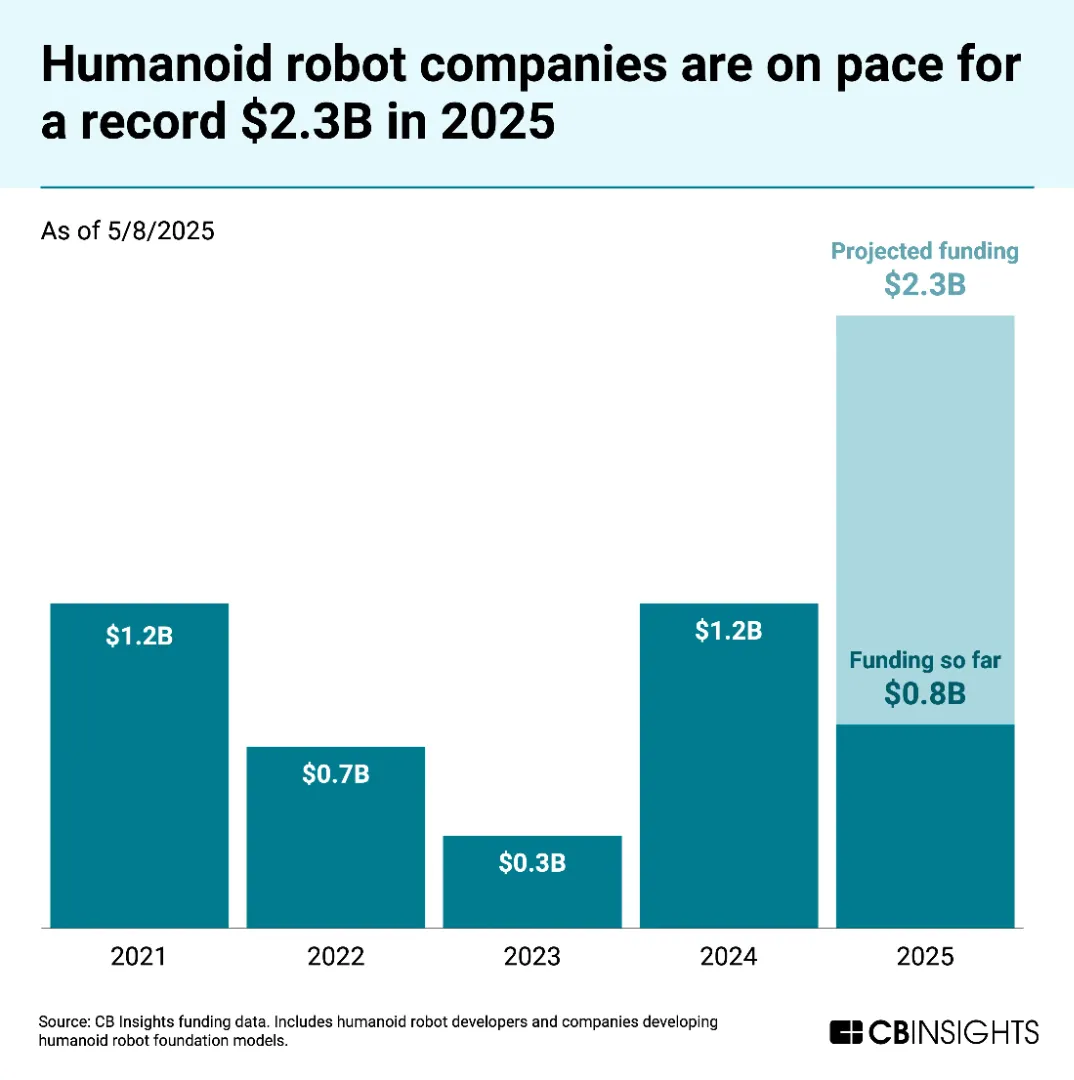

Humanoid robotics has absorbed billions of dollars in capital, spanning venture funding, strategic balance-sheet bets, and internal R&D programs across Big Tech, automakers, and AI companies. It is now one of the most aggressively funded hardware categories. The story is compelling, labor shortages, rapid AI progress, and the promise of general-purpose robots replacing human work. But the uncomfortable reality is that commercial revenue at scale is still close to zero. We are not seeing product-market fit. We are seeing capital moving faster than physics, economics, and deployment reality. That gap has grown large enough that even investors are publicly cautioning that humanoid robotics risks becoming the next tech bubble.

Let’s ground this discussion in data. A production-grade humanoid today typically carries a >$50k–$100k bill-of-materials cost at low volumes. Mean time between failures is often measured in hours or days, not industrial years. We are asking for human-level dexterity without human-level robustness, while absorbing negative unit economics once maintenance, downtime, safety certification, and insurance are included.

Companies like Figure AI have become bellwethers, exceptionally well funded, strategically backed, and ambitious. But even optimistic scenarios imply years of cash burn before breakeven, assuming manufacturing scale, safety frameworks, and paying customers all align. That is a long dependency chain in hardware. Tesla Optimus should be viewed as a capital-intensive experiment rather than a near-term product. Even with Tesla’s manufacturing muscle, building humanoids that are safe, reliable, and cheaper than human labor across tasks is likely a decade-long, multi-billion-dollar effort. Consumer-facing humanoids, including 1X and similar players, face an even steeper climb. Homes are unstructured, liability is high, and willingness to pay remains unproven. China’s humanoid ecosystem will likely ship volume first, backed by state support, but shipping units is not the same as building profitable companies.

The hard lesson from robotics history remains unchanged. General-purpose robots fail before narrow-purpose robots succeed. Industrial robots took decades to scale in fenced, predictable environments. Humanoids are being asked to work safely next to humans with reliability expectations closer to aviation than prototypes.

Bottom Line

My base-case view is blunt. Fewer than 10% of funded companies will survive five years from now. Most companies will pivot and tailor their offerings toward AI-focused systems for industrial and consumer use. A majority of today’s capital will be written off. Humanoids will matter, just not on the timelines investors and companies are betting on today.